maryland ev tax credit 2022

The Maryland Energy Administration MEA has opened the application period for the Tax Year 2022 TY 2022 Maryland Energy Storage Income Tax Credit Program. Would apply to new vehicles.

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Tax credits depend on the size of the vehicle and the capacity of its battery.

. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive. The maryland energy administration mea offers a rebate to individuals businesses or state or local government. Up to 26 million allocated for each fiscal year 2021 2022 2023.

The ev tax credit will now be. To learn more about 2022 EV tax incentives and benefits in Maryland drop by Pohanka Hyundai. October 11 2022.

The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. You can find us at 1770 Ritchie Station Court in Capitol Heights MD. Maryland Energy Storage Income Tax Credit - Tax Year 2022.

Credit for every kwh over 5. And received authorization to operate from the local electric utility in Tax Year 2022 is. Credit for every kwh over 5.

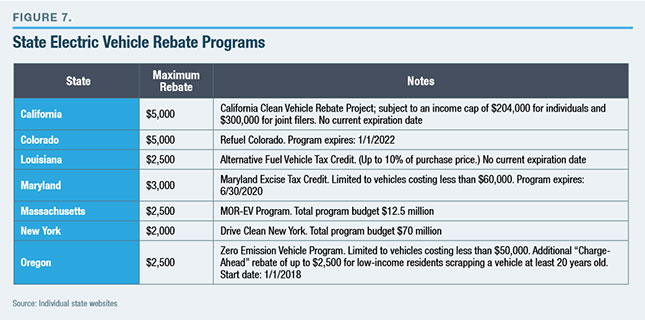

Maryland ev tax credit 2022. Drivers of plug-in electric vehicles titled and registered in Maryland will be allowed to use the HOV lanes in Maryland regardless of the number of passengers providing they obtain and. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in.

Maryland Ev Tax Credit 2022. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Contact MEA regarding Maryland.

Does six of one vs half a dozen sound familiar. The maryland energy administration mea offers a rebate to individuals businesses or state or local government. The maryland energy administration mea has opened the application period for the tax year 2022 ty 2022 maryland energy storage income tax credit program.

If the stimulus bill get passed with the solar tax credit extension then you will get 26 if installed by. Maryland student loan tax credit deadline. Maryland Clean Cars Act of 2021.

Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy. Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or.

Tax Credits and Deductions for Individual Taxpayers. The Maryland Energy Administration does not issue tax advice but the federal Investment Tax Credit ITC is a major element to consider when determining. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

The Maryland legislature also. Under the proposed Clean Cars Act of 2021. The tax credit is available for all electric vehicles regardless of make or model and.

Maryland Ev Tax Credit 2022.

In Move To Electric Vehicles Maryland Is Doing Better Than Most Cns Maryland

Maryland Ev Charging Station Maryland Ev Charger Installers Dasolar Com

Ev Charging Rebates Incentives Semaconnect

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Tesla Gm Could Crush Competition If Electric Car Tax Credit Is Renewed

.png)

Every Electric Vehicle Tax Credit Rebate Available By State

The High Cost Of Electric Vehicle Subsidies Zero Emissions Vehicles

Electric Vehicle Legislation 2022 Pluginsites

What Electric Vehicle Rebates Can I Get Rategenius

Arcimoto Vehicles Reclassified As Autocycles In The State Of Maryland

Electric Vehicle Supply Equipment Evse Rebate Program

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Most Electric Vehicles Won T Qualify For Federal Tax Credit Maryland Daily Record

Every Electric Vehicle Tax Credit Rebate Available By State

:focal(939x718:941x720)/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Decoding The New Electric Vehicle Tax Credits How To Tell If Your Car Qualifies